Chongqing - Most of China's financial service industries have been located alongside the coastal areas of Beijing, Shanghai, Shenzhen, whereas we look at Chongqing as a very promising inland megacity in terms of the fintech talent pool and government support, said Xu Fan, CEO of Saxo Financial Technology Limited, during an exclusive interview with iChongqing on March 10th.

Headquartered in Chongqing's Liangjiang New Area, Saxo Fintech is a new joint venture company set up by Saxo Bank A/S and Zhejiang Geely Holding Group Co., Ltd., which aims to bring world-class leading financial technologies to the Chinese market and drive up institutional innovations and development in the financial sector.

Xu Fan, CEO of Saxo Financial Technology Limited. (Photo by Truman Peng/iChongqing)

It only started business operations near the end of 2020, yet has already signed strategic partnership agreements with several of the country's leading banks, brokers, trusts, futures, and other financial institutions, providing financial technologies to a wide range of segmented markets such as trading service, regulatory technologies, risk management, CFETS, and cross-border arbitrage.

Earlier this year, the Chongqing Municipal Government issued an action plan for constructing the New Western Land-Sea Corridor, formerly known as the New International Land-Sea Trade Corridor (ILSTC), which clearly stipulates the necessity to "step up reform and innovation of financial industry and financial technologies."

"Saxo Fintech came in just about the right time when China further opens its financial market, and Chongqing is looking to build a financial hub in West China," Xu said. "We are very happy to have decided to come to Chongqing."

Reception desk of the Saxo Fintech's headquarters office in Chongqing. (Photo by Truman Peng/iChongqing)

Indeed, Chongqing has enormous untapped developing opportunities to offer when it comes to financial technologies innovation. Years ago, the city's Liangjiang New Area was set up as the country's first inland National Development and Opening Up New Area. It also enjoys the unique benefits of being a core area of the Chongqing Connectivity Initiative and an important node of the Belt & Road Initiative. The local government provides many preferential policies for industry newcomers and foreign investors to start a business here.

"Chongqing is a great place for Fintech companies to launch their businesses," said Xu. "And we hope with Saxo Fintech's world-class leading financial technologies and RegTech experiences, Chongqing can emerge as a fintech incubator to accelerate the development of financial industries in West China."

Launching ceremony of Saxo Fintech's business operation in China. (File Photo: Saxo Fintech )

Currently, China's financial technology mainly focuses on the innovation of consumer-side internet applications, whereas the core of the financial industry, such as trading, pricing, evaluation, and risk management, are still under exploration, with many high-level financial technology products and services highly reliant on foreign enterprises, which in and of itself creates a certain level of external risks.

Xu believes that Chongqing is already at the forefront of financial technology innovation in West China, as seen from the numerous successful cases of fintech companies starting from scratch here. However, it still lags in areas like trading, investment, and asset management.

"We can help Chongqing to compete with any other city in China, and hopefully in the world as well, we provide something that's going to be the future and complements what Chongqing needs," Xu added.

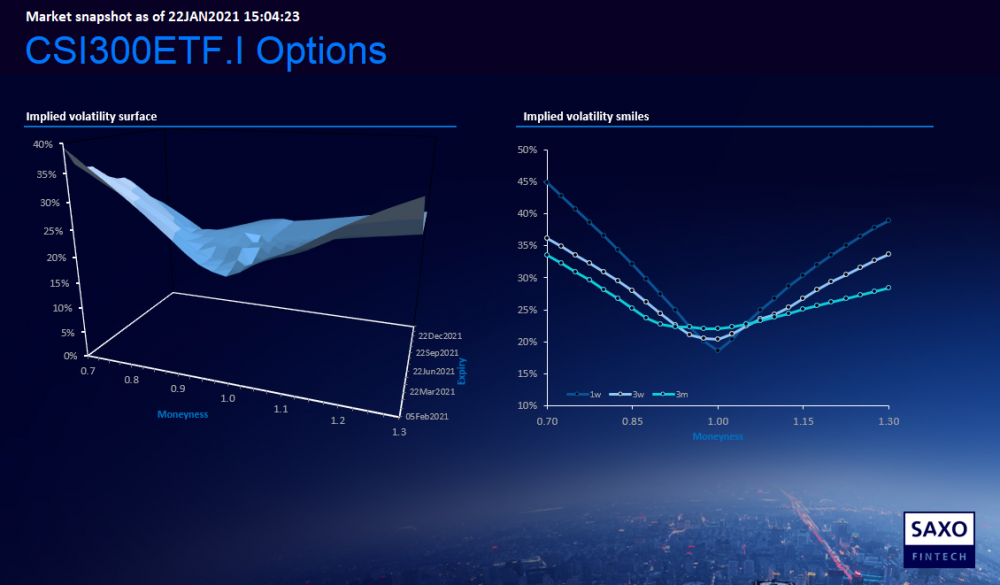

A snapshot of the CS|300ETF futures market model shows the correlation of implied volatilities, moneyness, and expiring date.

The People's Bank of China (PBOC) announced a financial technology regulatory trial scheme last year to boost domestic fintech companies' development. Chongqing is actually among the first batch of the fintech sandbox trials in China, together with Beijing, Shanghai, Shenzhen, Xiong'an New Area, Hangzhou, and Suzhou.

However, there's been an increasing need for the city to introduce more fintech talents and international investments to accommodate the financial industry's rapid development.

"Within China, Chongqing is a well-known tourism city, and also very industrial, well educated, and developed; but to foreigners outside, it's just another big remote Chinese city," Xu said.

Xu recommends the municipal government promulgate more preferential policies to incubate some seed companies first, and once these seed companies gradually grow into an ecosystem of successful business clusters, they will lure in even more companies to set up headquarters here -- with business comes talent, with talent comes capital -- and therefore driving the development of the whole industry.

Editor's Note: This article is the last in a four-part series featuring exclusive interviews with CEOs and general managers of foreign-invested enterprises, in which they are invited to talk about the improved business environment of Chongqing and China's 14th Five-Year Plan for Economic and Social Development against the backdrop of the now-concluded national "two sessions." You can find the series's part one here.

By continuing to browse our site you agree to our use of cookies, revised Privacy Policy and Terms of Use. You can change your cookie settings through your browser.

For any inquiries, please email service@ichongqing.info