Chongqing- A group of foreign residents in Chongqing from Singapore, Malaysia, and other countries was invited to open the digital renminbi (also known as the e-CNY) wallets at the launching ceremony of the e-CNY pilot project of the China-Singapore (Chongqing) Demonstration Initiative on Strategic Connectivity (CCI) on September 15.

The ceremony witnessed eleven e-CNY pilot application projects being signed. As a public product for the digital economy, digital RMB has the characteristics of safety, convenience, wide availability, settlement upon payment, and low cost.

Chongqing is one of the third batches of cities in the national digital RMB pilot project, and the CCI is one of the six featured application scenarios in the pilot.

Eleven e-CNY pilot application projects were signed at the signing ceremony. (Photo provided to iChongqing)

New International Land-sea Trade Corridor (ILSTC), China-Singapore (Chongqing) International Dedicated Connectivity (IDC), China-Singapore (Chongqing) Fintech Cooperation Demonstration Zone, and other critical project scenarios are highly compatible with the application of digital RMB, which can create international application chance for the e-CNY pilot.

The official launch of the pilot project marks the innovative application of digital RMB, which will facilitate a new exploration of e-CNY to effectively boost the construction of a western financial center and an international consumption center city, said Zeng Jinghua, Director of the China-Singapore (Chongqing) Demonstration Initiative on Strategic Connectivity Administrative Bureau (CCIB).

Digital RMB can provide more efficient and convenient payment options for Singaporean enterprises and foreigners in Chongqing, helping to optimize the business environment further and deepen the financial services for CCI, said Ma Tianlu, director of the Business Management Department of People's Bank of China (PBoC).

A group of foreigners from Singapore, Malaysia, and other countries opened e-CNY wallets at the ceremony. (Photo provided to iChongqing)

At the launching ceremony, seven pilot banks, including the Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), and Bank of China (BOC), signed eleven e-CNY cooperation agreements with CCI-related enterprises in their Chongqing branches with rich content and diverse scenarios, injecting vitality into the Chongqing e-CNY pilot.

A real estate investment trust listed in Singapore named SASSEUR Group, Raffles Hospital Chongqing invested by Singapore enterprise, Sino-Singapore Cancer Center (SSCC), and other digital RMB payment scenarios are included. Also, the New Land-sea Corridor Operation Co., Ltd. and CCI research center carry out the digital RMB innovation application research with banks.

The pilot application of e-CNY in CCI scenarios can support individuals using digital RMB for payment in business travel, talent training, medical care, shopping, and consumption scenarios.

Moreover, it can rely on ILSTC to explore the use of digital RMB for payment and settlement by enterprises in the economic and trade exchanges between western China and Southeast Asian countries. More application scenarios will be explored in the future, like aviation and wealth management.

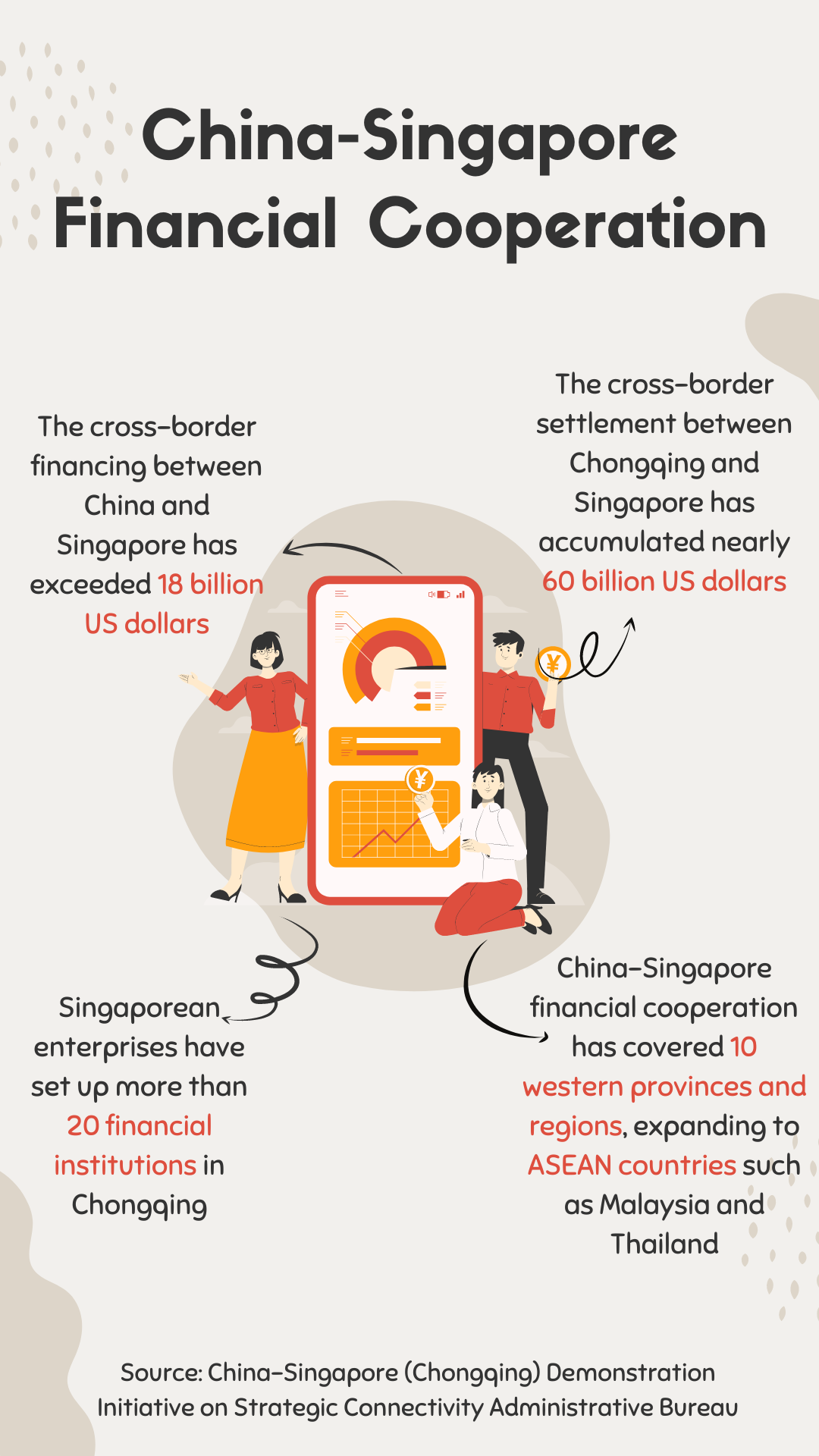

Statistics of China-Singapore financial cooperation. (iChongqing/ Chen Zhan)

The cross-border financing between China and Singapore has exceeded 18 billion US dollars, and the cross-border settlement between Chongqing and Singapore has accumulated nearly 60 billion US dollars. Singaporean enterprises have set up more than 20 financial institutions in Chongqing.

The expansion of the e-CNY pilot project to the CCI is of great significance for deepening China-Singapore financial cooperation. Chongqing and Singapore have conducted in-depth cooperation in the economic field over the years.

So far, China-Singapore financial cooperation has covered ten western provinces and regions, expanding to ASEAN countries such as Malaysia and Thailand.

Various Singaporean enterprises have participated in financial services, such as the Chongqing Pilots Qualified Domestic Limited Partnership (QDLP) and the Chongqing Digital RMB pilot project, which have effectively promoted the construction of the western financial center and the opening-up and development of western finance.

(Zhu Qinzhuo, as an intern, also contributed to this report.)

By continuing to browse our site you agree to our use of cookies, revised Privacy Policy and Terms of Use. You can change your cookie settings through your browser.

For any inquiries, please email service@ichongqing.info