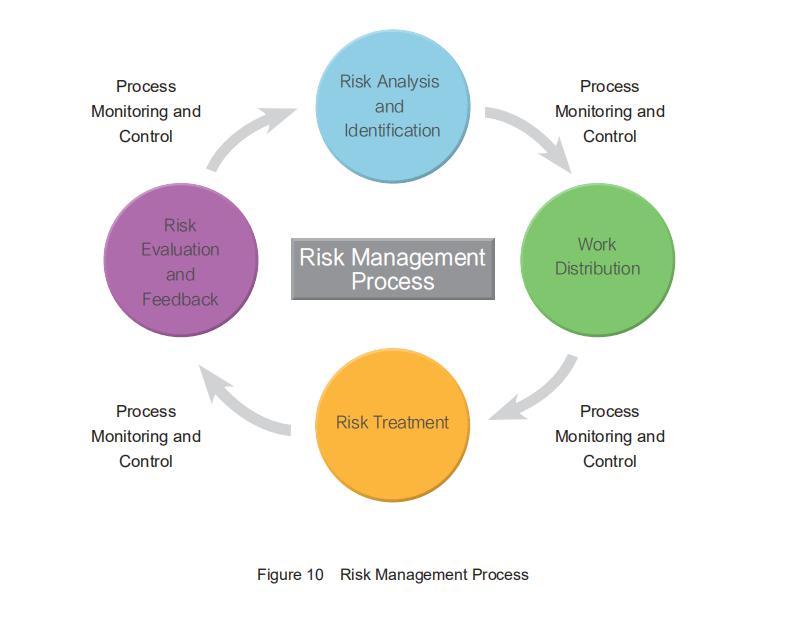

A variety of information types obtained from many sources and through different channels helps the Chinese tax administration to keep taxpayers on their radar. The risk management approaches adopted by the Chinese tax administration include risk analysis and identification, work distribution, risk treatment, process monitoring, evaluation, and feedback, constituting a turbocharger. (See Figure 10)

figure 10 - the risk management process

Tax returns filed by taxpayers are used to identify and analyze the compliance risks regularly by the Chinese tax administration with the integration of tax-related information in and out of the tax administration system. This was installed with analysis tools including built-in indicators of risk analysis, risk feature database, and industrial analyzing models. Taxpayers from whom tax revenues are potentially drained away are classified based on their risk ratings. For low-risk taxpayers, the tax authority will send risk alerts, asking them to prevent risks or revise their

returns. For high and medium-risk taxpayers, tax administrations will take measures to control risks, including compliance assessment, tax audit, anti-avoidance audit, and tax auditing. Meanwhile, tax administrations will correspondingly improve risk indicators and models on an ongoing basis after evaluating risk management processes.

In 2018, based on the Risk Management Platform, the STA performed specialized risk analysis on key industries and improved the accuracy of risk analysis. The STA also deepened and broadened the cross-region risk management coordination and cooperation. Lists of irregular households, D-level companies, and tax-owing taxpayers are shared across regions. Collaborations are made on risk alerts, information exchange, and risk investigation. The picture of nationwide vertical and horizontal collaboration in risk management emerged, which effectively improved

the tax compliance of taxpayers.

In 2019, the STA set up the Big Data and Tax Risk Management Administration to organize and guide big data and tax risk management activities across the country, establishing a professional organizational structure in the area.

Improving Risk Management Mechanism

Tax risk administrations at all levels across the country have taken full advantage of their professionalized organizations to carry out cross-regional risk treatment cooperation and advance national exchanges of tax risk information. Supported by information technology such as the cross-regional risk management system, autonomous monitoring, and warning of abnormal taxpayers have been realized, which has improved the tax risk management across the country.

Strengthening the Planning of Risk-Response Tasks

According to the requirement for overall planning in activities, methods, and working levels, the STA has utilized the function of identifying similar tasks in the risk management system to strengthen the overall planning of risk tasks and centralize the risk management, which has effectively boosted the efficiency of risk management work.

Strengthening Indicator Model Development

Giving full play to its advantage in data integration and processing, the STA has built up, enriched, and improved its tax risk indicator models and strengthened indicator model development, risk analysis, prevention, and control in high tax risk areas based on cross-sector and cross-regional data sourced from internal and external departments as well as the computing power and models of its cloud platform.