As China becomes a trade power, the stability in its foreign trade and investment is of great significance for the country's response to the impact of the COVID-19 pandemic and the steady development and continuous growth of its national economy.

Chongqing, the only trade function area in central and western China

Notice of the Ministry of Finance, the General Administration of Customs, and the State Administration of Taxation on Issues concerning the Policies for Conducting the Pilot Program of Promoting Trade Diversification in the Comprehensive Bonded Zone of Suzhou Industrial Park and the Lianglu Cuntan Bonded Port Area of Chongqing was released in 2014.

According to the document, eligible enterprises shall conduct trade, logistics, and simple processing in the trade function area.

These policies are available for enterprises located in the trade function area specially designated by Chongqing Lianglu-Cuntan Free Trade Port Area. The eligible enterprises should conduct businesses in the trade function.

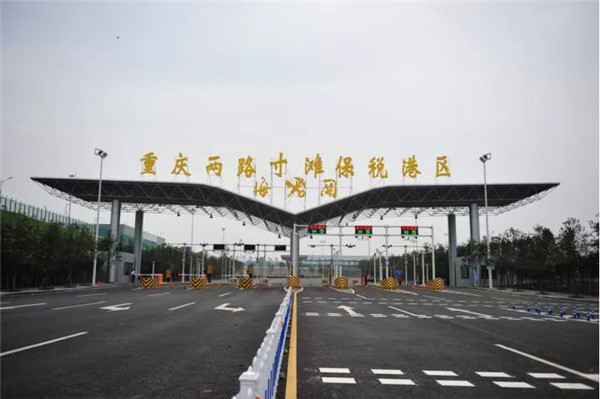

Chongqing Lianglu-Cuntan Free Trade Port Area Customs. (Photo/ Chongqing Lianglu-Cuntan Free Trade Port Area)

Unless otherwise provided by laws, regulations, and existing policies, the document specifies that goods transported to the trade function area from regions outside mainland China, special customs regulation zones, and bonded places of supervision shall enjoy the bonded system.

The trade function area allows the entry of non-bonded goods. Goods transported from places outside the area but inside mainland China will receive a tax refund with the exclusive exportation declaration to export tax rebates after they departed from mainland China. The eligible enterprises in the trade function area will be given the general taxpayer status of added-value tax.

For bonded goods transported to the trade function area from regions outside mainland China, special customs regulation zones, and bonded places of supervision, they shall continue enjoying the bonded system when being sold in the area.

When the bonded goods are sold in mainland China, import taxes will be levied by the customs in accordance with the goods' condition when entering the trade function area, and added-value tax will be levied by the relevant department under the provisions of selling goods in China.

When goods (including those containing bonded goods), except bonded goods, are sold in the trade function area or mainland China, the added-value tax will be levied by the relevant department per the provisions of selling goods in China.

If the goods sold in mainland China contain bonded goods, import taxes will be levied by the customs in accordance with the goods' condition when entering the trade function area.

The trade function area no longer implements the tax-free policy available in comprehensive bonded areas and bonded port areas for imported machines, equipment, and infrastructure materials.

Chongqing Bonded Port Area took the lead in upgrading itself into a "2.0 version" open platform that integrates the international and domestic markets and the resources in foreign countries and China.

That is of great significance for furthering the strategy of building Chongqing into an exemplary city of opening-up in inland China.

Guoyuan Port is an important point linking the construction of the Belt and Road and the Yangtze River Economic Belt. (iChongqing/ Vivian Yan)

Large-scale development in the western region

The Announcement on Continuing the Enterprise Income Tax Policies for the Large-Scale Development of Western China, issued in April 2020, makes it clear that from January 1, 2021, to December 31, 2030, the enterprise income tax will be levied at a reduced rate of 15% on enterprises engaged in the encouraged industries in the western region.

Enterprises engaged in the encouraged industries refer to enterprises that take the industrial projects specified in the Catalogue of Industries Encouraged to Develop in the Western Region as the main business and make the main business income account for more than 60% of their total income.

Industries contained in the Catalogue of Industries Encouraged to Develop in the Western Region include the production of engineering plastics, new chemical materials and prefabricated building components made of energy-saving and green materials, the technology development and equipment manufacturing of freshwater-source, soil-source and sewage-source heat pumps, the automobile manufacturing, the research, development and application services of cloud computing solutions, etc.

The scope of application of the policies for encouraging industries in western China covers 12 provinces (autonomous regions and municipalities directly under the Central Government), namely Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang (including the Xinjiang Production and Construction Corps), Inner Mongolia and Guangxi. They account for more than 70% of the national territorial area.

Besides, Yanbian of Jilin, Enshi of Hubei, Xiangxi of Hunan, and Ganzhou of Jiangxi implement the relevant policies in line with those of the western region.

This revision is carried out mainly to focus on priorities, address inadequacies, and shore up points of weakness.

It aims to facilitate the industrial structure adjustment, the industrial layout optimization, development, and growth of featured advantageous industries in the western region, and actively serve the new development paradigm with domestic circulation being the mainstay and the two circulations reinforcing each other.